Why Most Financial Advisors Don’t Want You to Know This One Rule

- IQSTechnicalTeam

- Aug 6, 2025

- 18 min read

Updated: Sep 26, 2025

Before diving in, take a minute to watch this quick video for a solid introduction—it sets the stage for everything you’ll read below.

Most people trust financial advice because it sounds unbiased. Big words, complex charts and long formulas often get tossed around, making it hard to know what actually helps you. The truth is, some simple rules for growing your money never make it into the conversation.

There’s one rule most advisors won’t spell out—because it doesn’t serve their interests. Knowing this can save you years of guesswork and thousands of dollars in hidden costs. In this post, you’ll see why the best rule for building wealth is usually the one least shared, and what makes it so powerful for everyday investors.

The True Role of Financial Advisors

Most people picture a financial advisor as a sort of money expert who always has your best interests at heart. They sit across the desk, smile, and promise to help you retire comfortably. But what if that picture doesn’t tell the whole story? The real job of a financial advisor isn’t always what clients expect. The details reveal a side of their work that’s more about the business of money than you might think.

Let’s pull back the curtain on what financial advisors truly do, so you know what’s actually going on when they give advice.

What Financial Advisors Are Actually Paid To Do

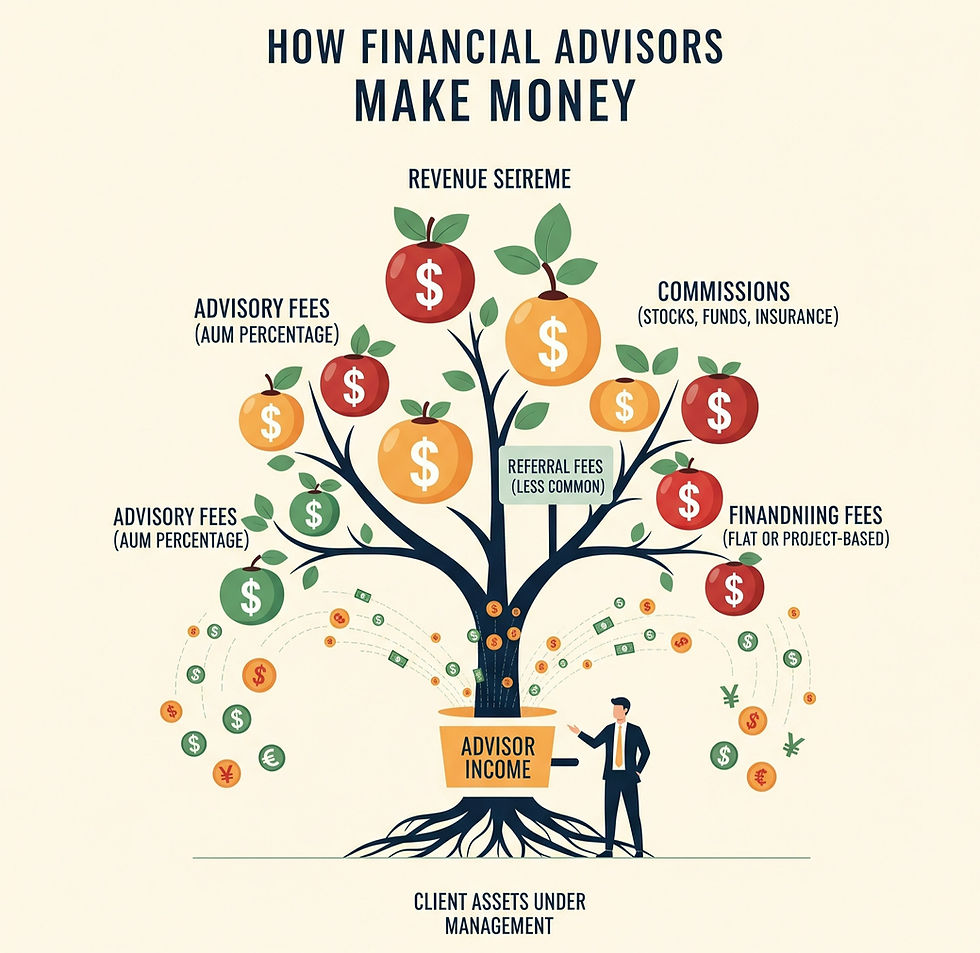

Every advisor has two jobs: help you manage your money and make a living doing it. Here’s where things can get blurry. Advisors often make money in three ways:

Commissions on products they sell (like insurance or specific funds)

Management fees based on how much money you invest with them

Hourly or flat fees for advice or one-time services

If someone gets paid based on what you buy, their advice can lean toward products that make them the most money. It isn’t always about your best result—it can be about their bottom line. That’s why some strategies never even hit the table.

The Gap Between “Advice” and Action

Even the friendliest advisor has goals to meet—often pushed by their firm or the way their job is set up. Sometimes, this means:

Pushing certain investments because they earn higher commissions

Suggesting complex products you don’t need

Steering clear of simple, low-cost options, even if these work best for regular folks

Advisors have bosses, sales targets, and noisy offices behind the scenes. Their advice might feel tailored, but it can be shaped by outside pressures clients never see.

Why Advisors Don’t Always Reveal Simpler Truths

You might think your advisor tells you everything. But the reality is, talking about plain rules—like basic index investing or spending less than you make—doesn’t keep you in their office or boost their paycheck.

If more people followed simple, time-tested rules, many advisors would have far less to sell. That’s why the one rule that could transform your money life often feels hidden, buried under paperwork, meetings, and complicated language.

Key Takeaways

It’s not about mistrusting every financial expert. It’s about being aware. Advisors offer value when you need complex planning or unique advice, but their true role mixes service with sales.

Know how your advisor gets paid.

Ask direct questions about fees and incentives.

Remember: sometimes, simple beats sophisticated.

By understanding the real job of a financial advisor, you can protect your interests and spot the advice that’s truly about helping you—not just their business.

How Financial Advisors Really Make Money

Most people expect a financial advisor’s advice to be shaped by training and honesty. What really shapes that advice? How they get paid. Not all financial advisors play by the same rules, and their payment models impact the guidance they offer, sometimes more than you’d imagine. The way a financial advisor earns a paycheck can lead to hidden costs, sway their decisions, and even conflict with your best interests.

Let’s break down how financial advisors really make money, what it means for your wallet, and why it could matter more than you think. Want to create serious Wealth at home, access this Recession Profit System.

Fee-Only, Commission-Based, and Fiduciary Advisors

The way financial advisors charge for their services falls into clear buckets. Here’s how to spot the difference:

Fee-Only Advisors

Key point: How an advisor makes money is often the biggest clue to what you’ll hear in their office. Never be shy about asking for a breakdown before you sign on.

Hidden Fees and Backdoor Commissions

The way financial advisors earn money isn’t always clear. Some charges are obvious, but many are baked invisibly into statements or fund costs.

Many clients have no idea they’re paying them.

Common hidden fees and commissions include:

12b-1 fees (small marketing expenses taken from mutual funds)

Sales loads (sales charges for entering or leaving a fund)

Revenue sharing (kickbacks to advisors for steering business to certain funds)

Wrap fees (bundled costs that hide extra layers of payment)

Some advisors quietly receive backdoor payments from fund companies or insurance firms for selling their products. These costs drain your long-term gains without you noticing. That’s why your results can lag behind the market, even if your advisor claims you’re on track.

Whose Goals Really Come First?

Financial advisors are people with bills to pay and targets to hit. Sometimes, their needs clash with what’s best for you. If your advisor stands to make more by steering you to complex products, that advice gets more tempting. Their incentives and your goals won’t always match.

Ask yourself, which matters more: your wealth or their commission? It’s not cynical, just smart. Focus on clear communication—ask for all the costs in writing, and don’t feel rushed. Simple works. If your advisor makes earning your trust feel easy rather than complicated, you’ve probably found someone with the right priorities.

Quick tips:

Always check if your advisor gets paid for selling products.

Get a simple written summary of their fees.

Remember, money motives can color advice, even from the friendliest expert.

Understanding how your advisor earns their income could save you thousands and years of frustration. Don’t ignore this detail—it can change your financial future.

The One Rule They Don’t Want You to Know: ‘Keep It Simple, Keep It Cheap’

It sounds almost too easy: The simplest and cheapest way to build wealth beats most strategies sold by financial advisors. Decades of research show low-cost, passive index funds often outperform expensive, complicated investments. This is the rule that gets swept under the rug—keep it simple, keep it cheap, and let the market do the work for you.

What Is the “Keep It Simple, Keep It Cheap” Rule?

Wall Street feeds on complexity. Fancy products and “secret strategies” keep advisors in business. But the buried truth: most people should just use broad, low-cost index funds. You don’t have to chase the next big thing or pay sky-high fees to do well.

Here’s what “keeping it simple and cheap” looks like:

Buy index funds: These track entire markets, like the S&P 500 or total stock market.

Pay rock-bottom fees: Many index funds charge less than 0.10% per year.

Stay invested long-term: Skip the urge to buy and sell based on headlines or predictions.

By skipping the hype and fees, you give your money the best odds for strong, steady growth.

Supporting Evidence: What the Numbers Say

Big investment firms and researchers back this rule up. Vanguard, one of the world’s largest fund companies, reports that most active managers fail to beat index funds over time. Even professionals rarely come out ahead when all costs are counted.

The S&P Dow Jones Indices “SPIVA” Scorecard compares real returns. Year after year, results look the same:

Over 85% of actively managed funds underperform their benchmark index over 10-15 years.

Index funds, which track those benchmarks, come out on top due to lower costs and less trading.

These facts aren’t whispered in the advisor’s office because they prove you don’t need help picking “winning” funds. Access this Recession Profit System here.

How Simplicity and Low Costs Put More Money in Your Pocket

It’s easy to fall for fancy options, but here’s why simple, cheap investing works so well:

Lower fees mean higher returns for you. Paying 1% or more a year in fees can slice thousands from your future nest egg.

Simple portfolios are easier to follow. Fewer moving parts means less chance to make costly mistakes.

Index funds keep emotions in check. With set-it-and-forget-it investing, you dodge panicked moves and second-guessing.

Let’s break it down even further. Imagine two people each invest $10,000. One uses a low-cost index fund (0.05% fee), the other chooses a “hot” fund (1.25% fee). If both earn 7% before fees, in 30 years the index fund investor ends up with tens of thousands more, thanks to lower costs.

Why Advisors Don’t Push the Simple Approach

Most advisors rely on commissions or management fees. They often skip this one rule because:

Simple index funds don’t pay high commissions.

It’s hard to justify big fees for simple advice.

Complexity keeps clients “hooked” and paying for help.

If people knew this rule, the business would look different. Instead of selling expensive, hard-to-understand investments, advisors would focus on honest, low-cost planning—or risk losing clients to “do it yourself” investing.

Key Benefits of Keeping It Simple and Cheap

Choosing this path unlocks true financial freedom for everyday investors. Here’s a quick summary:

Save money on fees

Reduce emotional decisions

Spend less time managing your money

Consistently match or beat most professionals over time

Money doesn’t have to be a mystery. By following the “keep it simple, keep it cheap” rule, you give yourself the best shot at steady wealth without all the drama.

Why This Rule Isn’t Popular Among Advisors

Advisors rarely advertise the simplest rules for building wealth. Most shy away from teaching clients to “keep it simple, keep it cheap,” because it cuts into the heart of how their business works. When simple rules threaten the bottom line, they often get pushed aside. Here's why advisors prefer to keep this powerful secret under wraps. Want to create serious Wealth at home, access this Recession Profit System.

Simple Rules Don’t Generate Big Commissions

Advisors work hard to earn a living, and much of that income comes from selling products or managing investments. The “keep it simple, keep it cheap” approach uses tools like index funds and long-term holding, which pay advisors little or nothing in commissions or management fees. When clients do more themselves, advisors have fewer ways to earn.

Here’s what happens behind the scenes:

Index funds don’t pay high commissions. Advisors often earn bigger rewards by recommending complex or niche investments that carry higher fees or sales charges.

Low-maintenance portfolios mean fewer meetings. Fewer touchpoints can make clients feel they need less advice, which often equals lower fee revenue.

Advisors thrive when clients rely on them for ongoing, hands-on management. Simplicity undercuts that need.

Fewer Touchpoints, Less “Perceived Value”

A simple, low-cost investing plan runs quietly on autopilot, so clients may only need check-ins now and then. For advisors, this means less time spent justifying their fees or meeting regularly to “tweak” a portfolio. When clients see fewer interactions, they question why they’re paying ongoing fees.

Advisors often do the following to maintain perceived value:

Schedule detailed reviews that overcomplicate simple portfolios

Suggest adjustments that aren’t necessary just to show activity

Offer frequent updates that sound reassuring but add little substance

If clients realize that set-it-and-forget-it investing works, they might decide to keep more money in their own pockets, not in the advisor’s.

The Business Model Depends on Complexity

The financial industry is built around layers of products, fees, and advice that seem important but often add little real benefit. Simple investing rules strip away the layers and expose the basics. When that happens, the industry’s approach comes into question.

Complexity offers:

More opportunities to sell premium services

Justification for higher management and planning fees

A continuous flow of revenue from frequent changes or product swaps

The more confusing things seem, the more likely clients feel they need experts to sort it out. Simplicity, by contrast, can make advisors worry they’ll lose their edge—or their paycheck.

Advisors Worry About Job Security

Most advisors aren’t bad people—they’re just working to support their families and careers. If every client embraced this one rule, many traditional business models would face real challenges. Instead, complexity keeps the wheels turning.

Common concerns include:

Losing clients to do-it-yourself investment platforms

Reduced need for costly ongoing services

Fewer opportunities to cross-sell products and insurance

When the easy answer works, the reason to pay more goes away. Simple investing threatens the stability of the old way of doing business.

Key Points to Remember

Understanding why this simple rule is not popular with advisors helps you see the business side of financial advice. Complexity keeps clients paying and advisors earning, while simplicity quietly builds wealth in the background. When something is simple, there’s just less for advisors to “do”—and that’s exactly the problem for them.

How You Can Apply the Rule to Your Own Finances

Many people think managing their money is too hard or needs a professional in their corner. Truth is, you can put the “keep it simple, keep it cheap” rule into action right now without needing to pay someone else. With a few steps and the right tools, you can build wealth with confidence and clarity.

Use DIY Platforms: Vanguard, Fidelity, and Schwab

You don’t need insider connections to start. Trusted brokerage firms make it shockingly simple to build your own plan online. Platforms like Vanguard, Fidelity, and Schwab are designed with regular investors in mind.

Here’s why these platforms stand out:

Low (or zero) account fees keep more money in your pocket.

Huge selection of index funds and ETFs at rock-bottom expense ratios.

Easy-to-use websites and apps help you handle the basics, no expertise required.

You can open an account, answer a few staring questions, and get rolling in less than an hour. No need to wait weeks for an appointment or fork over hefty management fees.

Build a 3-Fund Portfolio for Simple Success

You don’t have to pick from hundreds of funds. A 3-fund portfolio keeps things simple but balanced.

Here’s the classic breakdown:

U.S. Total Stock Market Index Fund Covers big and small American companies, giving you a slice of the entire U.S. economy.

International Stock Market Index Fund Brings in exposure to markets outside the U.S. for added diversity and more growth potential.

U.S. Total Bond Market Index Fund Adds stability, acting as a buffer during rough times in the stock market.

Why does this approach work?

It covers thousands of companies and bonds, spreading out risk.

Index funds in each category cost very little to own.

It cuts out guesswork and high fees.

Most big brokerages have these funds ready-made. You can set up your mix (for example, 60% stocks/40% bonds) depending on your goals and comfort with risk.

Automate Your Wealth Building

The less you have to think about investing, the more likely you’ll stick with the plan. All the top DIY platforms let you automate your strategy so you can build wealth in the background while life happens.

Set up automatic transfers from your bank to your brokerage account. Choose how much goes into each part of your 3-fund portfolio. Most platforms let you:

Schedule deposits (weekly, monthly, or with each paycheck)

Automatically buy your chosen funds on your schedule

Even reinvest your dividends, so every dollar keeps working for you

Automation crushes excuses. You don’t have to time the market, remember to log in, or worry about missing an investment window.

Keep Costs (and Stress) Low

Smart investing means paying attention to the fees you pay on your funds. Index funds on major DIY platforms often have expense ratios under 0.10%. Actively managed funds or fancy products can easily run 10 times higher.

Here’s a quick checklist to keep you on track:

Use tools that break down all your costs.

Stick with proven, boring index funds.

Ignore hot stock tips and short-term trends.

Remember, the more you pay in fees, the less you keep in profits. Keeping it simple shines in the long run.

Make It Yours and Get Started

This isn’t just a theory—it’s a real-life shortcut you can put to work. No expensive suits, no flashing charts, no waiting room. Open your account, pick your three funds, and set up automatic investing. In just a few moves, you do what most financial advisors don’t want you to know is possible: build wealth on your own terms.

Bonus: Questions to Ask Any Financial Advisor Before Hiring Them

Getting the right financial advisor can change your money life for the better or, if you pick wrong, saddle you with unnecessary fees and headaches. Many advisors sound the same on the surface, so it's smart to ask clear, direct questions before you trust them with your cash. This section breaks down the most important questions you should bring to the table—along with why each one matters.

Are You a Fiduciary at All Times?

Start by asking if the advisor is always a fiduciary. A fiduciary must put your interests ahead of their own, every step of the way. Some advisors are only "fiduciaries" when drafting a plan and then switch to selling products where those rules disappear. Ask them:

Will you act as a fiduciary in all of our interactions?

Can you put this in writing?

Why it matters: If they dodge or give a fuzzy answer, walk away. This one question can sort real partners from fast-talkers in seconds.

How Do You Get Paid?

Knowing how your advisor gets paid protects your wallet from hidden costs and biased advice. Get the full answer, in writing. Ask:

What are all the ways you receive compensation?

Do you receive commissions, flat fees, or asset-based fees?

Will you provide a breakdown of my total costs every year?

Why it matters: If their pay depends on selling certain funds or insurance, expect their advice to push you in that direction. If you can't understand how they earn money, keep looking.

What’s Your Investment Philosophy?

Everyone has a philosophy about investing—even if they can't explain it well. Top advisors stick with strategies backed by research, not hype. Ask:

How do you decide what I should invest in?

Do you believe in index funds, active management, or something else?

How do you handle market downturns?

Why it matters: Watch out for anyone promising to "beat the market" or sell you on complex products. You want a simple, direct answer that lines up with your long-term goals and comfort level.

How Will You Tailor Advice to My Situation?

A good advisor considers your total life, not just your investment account. Ask for specifics about how they plan to serve you, not just a generic list. Key questions include:

How often will we meet or communicate?

What’s your process for understanding my needs and goals?

Will you help with things like taxes, estate planning, or college savings—or just investments?

Why it matters: This helps you spot cookie-cutter advice and see if they’ll actually spend time thinking about you and not just your account size.

Can You Show Me Real Client Success (Anonymized)?

Request examples of how they’ve helped people in situations similar to yours. No names needed, but real stories show whether they practice what they preach.

Can you share examples (with private details removed) of how you’ve helped clients like me?

What challenges did they face and how did you help?

Why it matters: You want to see their track record and how they communicate results.

What Happens if I Leave or Am Unhappy with Your Service?

It’s important to know you can walk away without big penalties or a long fuss.

Ask directly:

Is there a lock-in period or cancellation fee?

How do I move my money if I decide to leave?

Why it matters: A confident, ethical advisor keeps the door open. If they dodge or get nervous, that's a red flag.

Quick List: Questions to Print or Save

For easy reference, here are the essential questions to bring to your first advisor meeting:

Are you a fiduciary at all times?

How do you get paid, and are there hidden fees?

Can I get a written fee breakdown each year?

What is your investment philosophy?

How will you tailor your service to my needs?

Can you show anonymized success stories?

What happens if I want to leave?

Bottom line: The smarter your questions, the fewer surprises for your future self. Interview your advisor like you’d interview someone caring for your kids. Only work with someone who welcomes every question and answers with clear, honest details.

But Here's the Other Side: Not All Advisors Are Hiding This

It’s easy to get cynical and paint all financial advisors with the same brush, but reality is rarely black and white. Many advisors do share the “keep it simple, keep it cheap” message and recommend easy, low-cost investing. The real difference is in how they add value beyond just picking funds or timing the market. Let’s look at the advisors who do it right, their approach, and why some people still want a professional in their corner.

Not Every Advisor Hides Simple Strategies

Many fee-only and fiduciary advisors push simplicity and transparency. Their business grows by building lasting relationships, not selling the latest financial fad. These advisors:

Recommend low-fee index funds and ETFs

Use simple strategies for clients who want to “set it and forget it”

Put all fees and incentives in writing

A good advisor is proud to say, “We use what works. You don’t need to pay more or make things complicated for great results.”

“The best advice is advice that’s easy to follow. I tell my clients that boring works. Index funds and simple plans protect you from expensive mistakes,” says Sarah Adamson, CFP®, a fee-only advisor who openly posts her fees online.

The Real Value: More Than Picking Investments

Advisors who “get it” know their true strengths aren’t about chasing returns or timing the market. Instead, they offer value in key areas that software and apps can’t match:

Behavioral coaching: The biggest danger for most investors is their own panic or greed. A calm, steady advisor talks you off the ledge during market drops and keeps you from bailing at the wrong time.

Tax planning: Taxes can eat into gains fast. Advisors help you build strategies to keep more of what you earn, like using the right accounts or rebalancing smartly.

Estate and life planning: Big life events—marriage, retirement, passing down money—need more than just picking an index fund.

Accountability: Some clients want regular check-ins to stay on track and feel confident. Sometimes, having a pro in your corner helps you stick to your plan.

It’s like hiring a personal trainer. You know how to use the treadmill, but a coach keeps you moving when motivation fades.

Why Some Investors Still Want an Advisor

Apps and online tools are strong, but they don’t comfort you after a major market drop. Not everyone wants to manage things solo, even with a simple plan.

You might benefit from an advisor if you:

Struggle to ignore market headlines and stick to your plan

Need help setting up efficient withdrawals in retirement

Want expert support for big decisions, like inheritance or college savings

Good advisors understand that coaching and planning make the biggest impact, not just picking the right fund.

What to Look for in a Transparent Advisor

Spotting an honest, client-first advisor isn’t hard if you know what to check:

They talk openly about fees and put everything in plain language

They recommend simple, proven strategies without lots of jargon

They don’t guarantee outlandish returns or push you into products you don’t understand

They focus on your goals first, not just your investment balance

Quick tip: Trust your gut. The right advisor listens more than they talk and makes you feel confident, not confused.

Bottom line: Not all advisors avoid simple, effective strategies. The best ones are transparent, keep things straightforward, and add value where it really counts: supporting you, guiding your decisions, and keeping your money life calm and clear.

Financial Clarity is Power

Most financial advice gets wrapped in mystery, leaving you unsure what's real and what's just sales talk. The real advantage comes from understanding your money without noise or confusion. When you know the rule most advisors keep quiet—keep it simple, keep it cheap—you step outside the usual playbook and make choices that put you in control. Let’s break down why financial clarity will always beat clever marketing, and why simple rules can outshine even the fanciest strategies.

The Real Impact of Clarity

Clear, simple advice does more than grow your bank account. It gives you confidence and puts you back in the driver’s seat. Instead of second-guessing your every move, you can focus on what really matters: keeping more of what you earn, spending less time worrying, and building lasting security.

A clear financial plan helps by:

Cutting out hidden fees that drain your returns

Letting you see progress instead of chasing empty promises

Lowering your stress, since you know what you own and why

People make better decisions when they understand what’s going on. That’s true whether you manage your investments solo or get help from a trustworthy advisor.

Why Simplicity Wins Every Time

It’s easy to think complex systems work better. In truth, simple rules often double your odds for success. When you stick with “keep it simple, keep it cheap,” you:

Avoid tricky products with high costs and poor results

Save time on research, paperwork, and meetings

Get steady results that let you compound your gains over years

You don’t have to reinvent the wheel or learn every Wall Street trick. The big secret is that boring, low-cost index fund investing works better than most high-priced “expert” strategies.

Questioning Conventional Wisdom Makes You Stronger

You don’t have to take anyone’s word for it, not even your advisor’s. Asking tough questions and checking if an approach makes sense for you gives real power. Remember, smart investors don’t blindly follow advice—they ask how and why things work.

Here’s a checklist for keeping financial clarity front and center:

Ask for details: If something sounds complicated, request a plain English explanation.

Check the math: Compare fees and results side by side. Do simple solutions hold up?

Trust your gut: If it feels wrong or confusing, slow down and do more homework.

When you push back against buzzwords and complexity, you protect your wallet. You get more out of every dollar saved and invested.

The Rule Still Holds True

Let’s circle back—“keep it simple, keep it cheap” is the quiet rule that can rewrite your money story. You don’t need special access or inside knowledge to use it. You just need the courage to question what you’re told and the willingness to stick to clear, proven steps.

Every time you choose clarity over confusion, you build not just wealth but peace of mind. And once you see simple wins work firsthand, you’ll never look at financial advice the same way again.

Conclusion

Simple, low-cost investing has been the quiet winner for everyday people, no matter what the sales pitch says. When you stick with this approach, you keep more of your money working for you, not someone else. The best results often come from tuning out noise and just letting time and simple tools do their job.

You don’t need special access or complicated strategies to build lasting wealth. Protect what you’ve earned by choosing clear, proven steps and asking questions that keep you in control. If this opened your eyes, don’t stop here—keep learning, compare options, and share what you find with someone else. Your future self will thank you for getting it right, starting today.

If you enjoyed reading this article read our other blog article: Smarter Investing in 2025 and The Future of Financial Advising

Gain Access these proven financial tools from here 1) AI-Powered trading tool 2) Recession Profit System.

Disclosure: We aim to provide readers with valuable, authentic, and informative insights by combining human expertise with AI, such as large language models to augment our ability to exploit unique perspectives and uncover new use cases. This ensures our blog meets the highest standards of trustworthiness, expertise, authoritativeness, and trustworthiness offering content that is both helpful to our readers. This post contains affiliate links including Amazon link, we are likely earn a small commission at no cost to you if you make a purchase through these links.

Comments